Asset Disposal Journal Entry

Since the asset had a net book value of 3000 the profit on disposal is calculated as follows. The journal entries required to record the disposal of an asset depend on the situation in which the event occurs.

Disposal Of Pp E Principlesofaccounting Com

1- If the sale amount is 7000.

. To remove the asset credit. Removing the asset removing the accumulated depreciation recording the receipt of cash and recording the gain. To create a disposal journal go to Fixed assets Journal entries Fixed assets journal and then on the Action Pane select Lines.

This journal entry is made to remove the 10000 equipment that has been fully depreciated and is no longer useful for our business as of December 31. The yearly deterioration cost is 1000. To review and revise disposal entries.

Lets consider the following example. JJV Waste Removal Corp. Select Disposal scrap and then select a.

To locate a single disposal journal entry complete the following fields. Journal Entries For Retirements And Reinstatements Oracle Assets Help Disposal Of Pp E Principlesofaccounting Com. Dispose of regulated waste the right way.

Likewise there is no impact on the. Is a family owned and operated garbage trash and rubbish removal company. Before the finish of the.

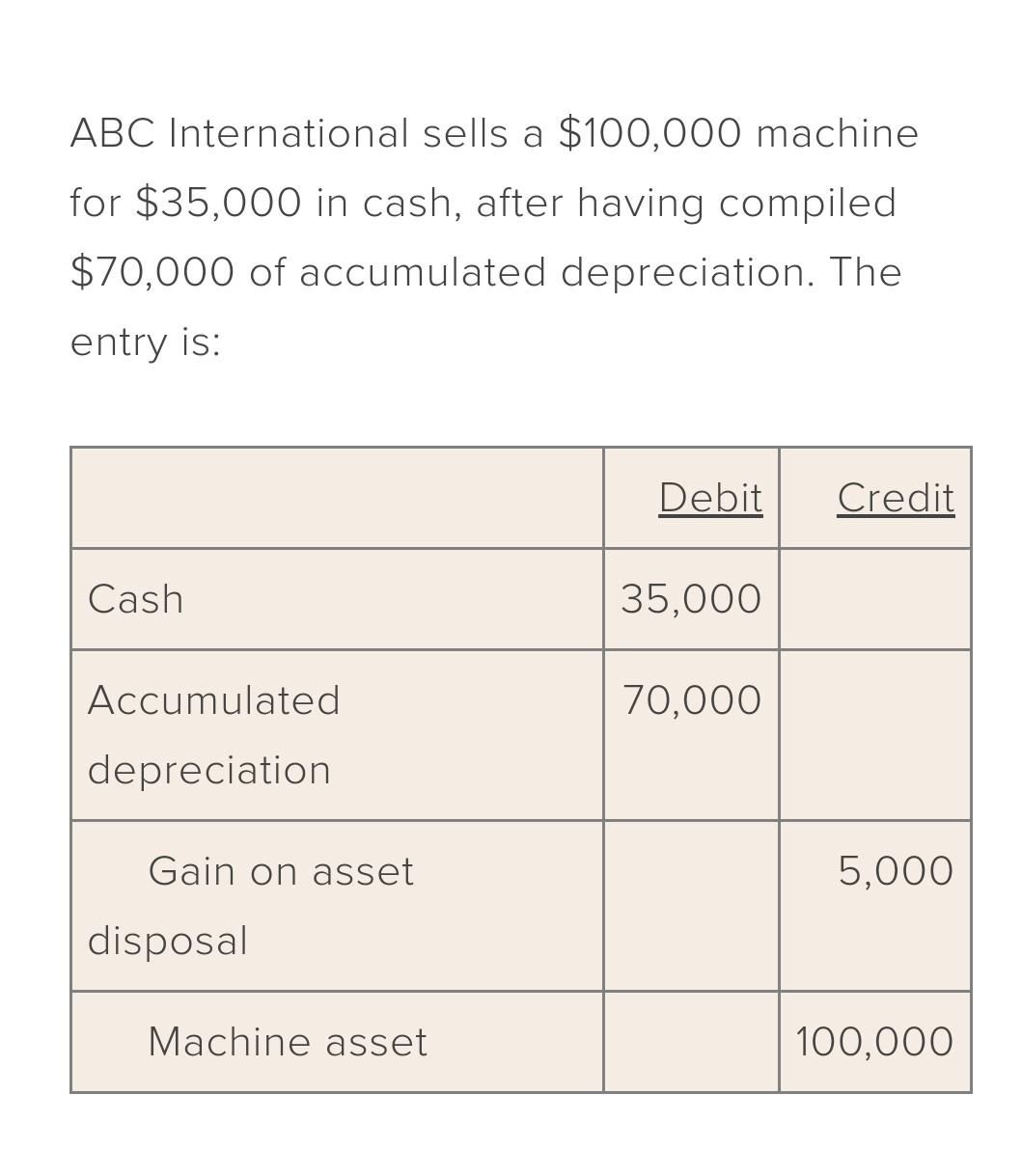

Let our trusted reliable team provide you with a compliant cost-effective solution when removing your biohazard or. The fixed assets journal entries below act as a quick reference and set out the most commonly encountered situations when dealing with the double entry posting of fixed. Profit on disposal Proceeds - Net book value Profit on disposal 4500 - 3000.

Sells the equipment for 7000 it will make a profit of 625 7000 6375. Disposal of plant assets. Apply to Asset Manager Management Analyst Front Desk Agent and more.

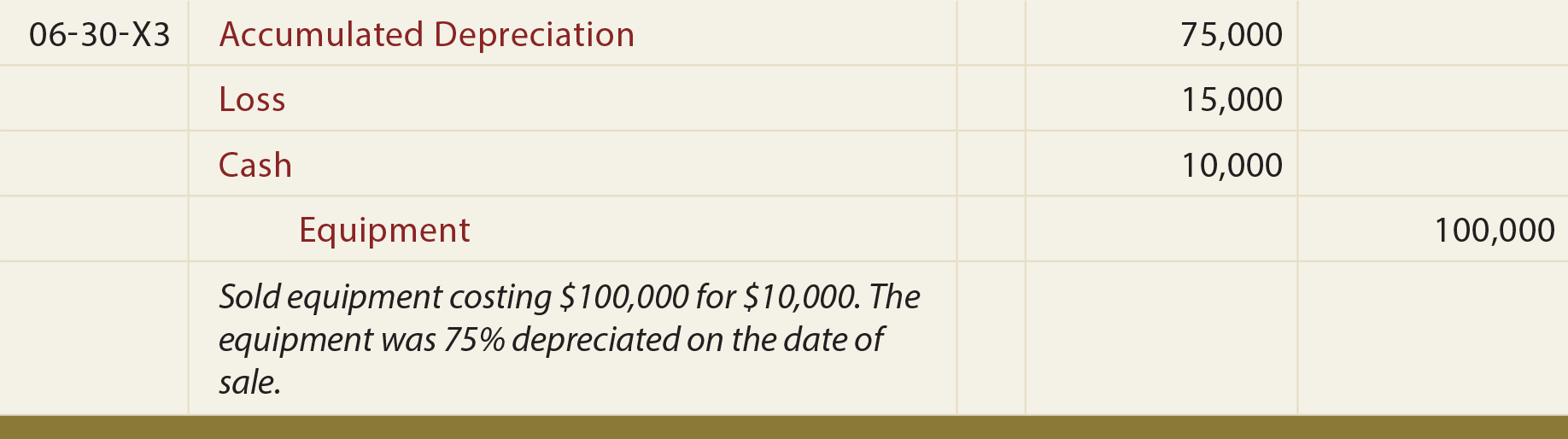

Journal Entries for Asset Disposals. Fully Depreciated Scrapped Asset Disposal Journal Entry. Disposal of fully depreciated assets.

No comments for Asset Disposal Journal Entry. My name is Vince Favarolo and together with my brother. In this case ABC Ltd.

All plant assets except land eventually wear out or become inadequate or obsolete and must be sold retired or traded for new assets. Disposal of fixed assets is accounted for by removing cost of the asset and any related accumulated depreciation from balance sheet recording receipt of cash and. Learn about our waste disposal and compliance training solutions to find the.

The journal entry will have four parts. Can make the journal entry for the profit on sale of. We understand the types of medical waste you need to properly dispose.

The assessed administration life of the machine is three years. In this case we can make the journal entry for the 20000 equipment disposal by debiting the cash account with 4500 and the accumulated depreciation account with 16000 and. On Single Asset Disposals.

45000 cost - 14000.

Journal Entries For Retirements And Reinstatements Oracle Assets Help

Fixed Asset Accounting Disposal Of Fixed Asset Accounting Corner

Solved I Need A Detailed Step By Step Explanation Of These Chegg Com

No comments for "Asset Disposal Journal Entry"

Post a Comment